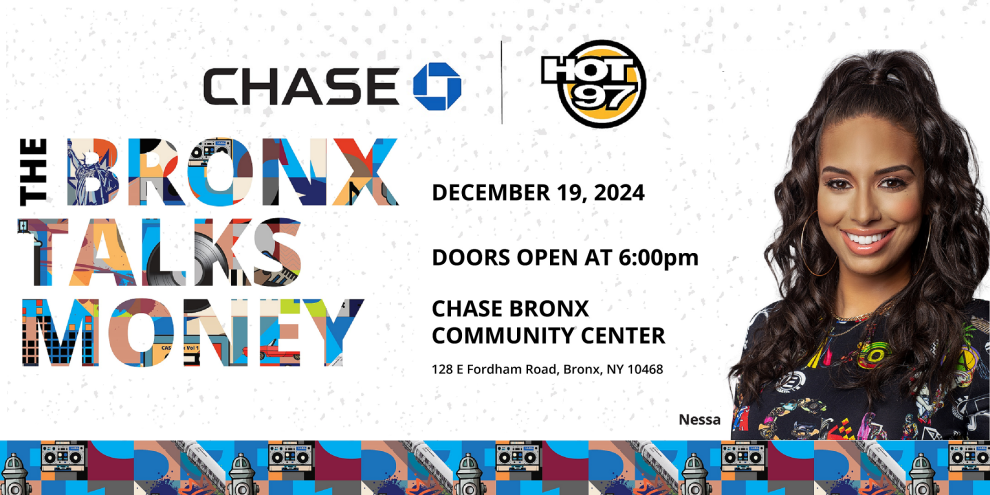

The holiday season is the perfect time to reflect on financial habits and learn new strategies for managing money. On December 19, HOT 97’s Nessa hosted “The Bronx Talks Money!” at the Chase Bronx Community Center, bringing together experts and community leaders to discuss key financial topics like budgeting, investing, saving, and building credit.

Sponsored by HOT 97 and Chase Bank, the event featured an engaging panel discussion with Monica Nation, Regional Director for Consumer & Community Banking at Chase, and Sherlyn Santana, Vice President and Community Manager at Chase. Lorane Rodriguez, Executive Director for Community & Business Development at Chase, moderated the forum.

A Personal Take on Financial Literacy

During the discussion, Nessa shared her personal journey with money management, revealing her struggles and lessons learned.

“In my 20-year career and just in general, I made a lot of mistakes with money,” she admitted. “I didn’t have the financial workshops ahead of time to avoid certain mistakes. Finances are so broad—there’s budgeting, credit, debt, savings, or opening a bank account. It’s just so much to tackle and deal with.”

As a co-founder of the Know Your Rights campaign with Colin Kaepernick, Nessa highlighted the program’s efforts to teach financial literacy to youth. She recalled a moment in Chicago when a 15-year-old boy expressed his desire to make money to support his family and community.

“That was so powerful,” she said. “Imagine if our youth had the resources they needed. They’re brilliant, and we need to help them tap into that brilliance.”

Expert Insights from the Panel

The panelists shared practical advice and insights to empower attendees:

- Monica Nation emphasized the importance of HOT 97’s connection with the community. “HOT 97 is the home of hip-hop. They’re the voice of the people. We want to be intentional, speak plain English, and connect with audiences authentically.”

- Sherlyn Santana focused on the critical role of credit in creating generational wealth. “Credit is the foundation of financial health. Latinos and African Americans own the least amount of homes because financial literacy was never taught to us. We need to educate ourselves and our kids about these tools.”

Saving for a Rainy Day

Nessa closed the session with a sobering reminder of the importance of emergency savings.

“It’s very concerning when I hear that a couple hundred dollars on a rainy day can completely bankrupt a family,” she said. “Save your money because there will be a rainy day. That couple hundred dollars could determine whether you have a roof over your head or not.”

A Resourceful Forum for the Community

The forum highlighted the vital role of financial literacy in empowering communities and fostering long-term stability. To view the entire event and gain actionable insights, check out the link provided below.

Stay tuned for more updates on community initiatives, financial resources, and empowering programs!