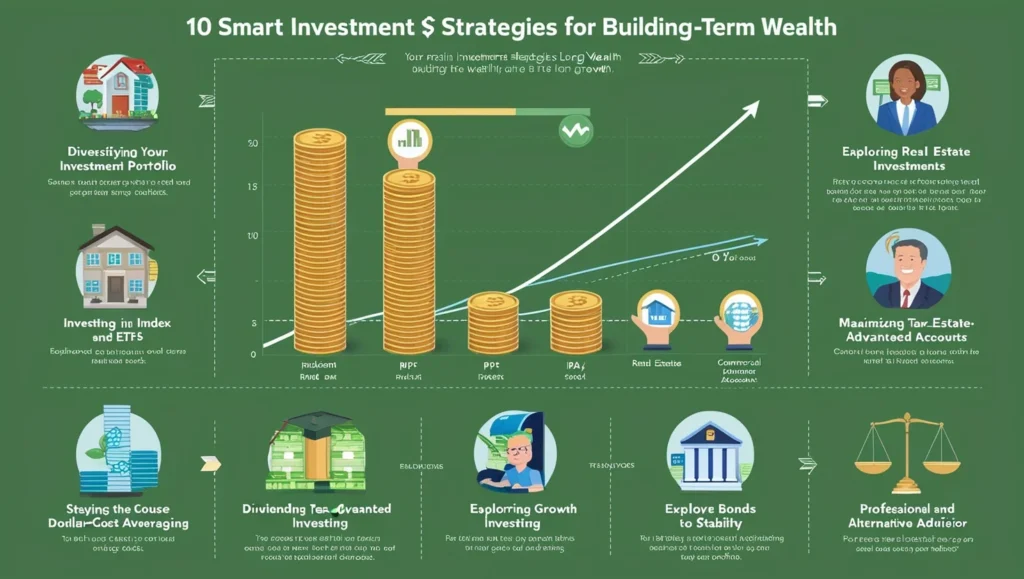

Investing is one of the most effective ways to build wealth over time. But with so many options—stocks, bonds, real estate, and more—how do you choose the right strategy to secure your financial future? In this comprehensive guide, we’ll explore proven long-term investment strategies that can help you grow and protect your wealth, even during economic downturns.

If you’re ready to create a portfolio that withstands the test of time, let’s dive in!

1. Diversify Your Investment Portfolio

Diversification is the golden rule of investing. By spreading your investments across different asset classes, you reduce risk and increase the potential for steady returns.

Why Diversify?

- Stocks: High-growth potential, especially for long-term wealth building.

- Bonds: Stability and a hedge against market volatility.

- Real Estate: Tangible assets that appreciate over time and generate passive income.

Tip: Avoid over-diversification, which can dilute returns. Aim for a balanced portfolio tailored to your risk tolerance and goals.

2. Harness the Power of Index Funds and ETFs

Index funds and ETFs (Exchange-Traded Funds) are ideal for beginners and seasoned investors alike. They offer a low-cost way to invest in a diversified portfolio.

Benefits of Index Funds and ETFs:

- Cost-Efficiency: Lower fees than actively managed funds.

- Diversification: Invest in a broad market with a single fund.

- Consistent Growth: Historical data shows steady long-term returns.

Start with platforms like Vanguard or Groww to explore domestic and international funds.

3. Unlock Real Estate’s Wealth-Building Potential

Real estate remains one of the most reliable long-term investment options. You can choose between direct property ownership or Real Estate Investment Trusts (REITs).

Advantages of Real Estate:

- Capital Appreciation: Properties generally increase in value over time.

- Passive Income: Rental properties provide a steady cash flow.

- Portfolio Diversification: A tangible asset that balances market-linked investments.

Start small with REITs or explore emerging real estate markets for higher growth potential.

4. Maximize Tax-Advantaged Accounts

Tax-advantaged accounts are a game-changer for building long-term wealth.

Best Options to Consider:

- 401(k) and IRA: Popular in the U.S., these accounts offer tax benefits for retirement savings.

- Roth IRA: Allows tax-free growth and withdrawals in retirement.

- PPF and NPS: Top choices in India for tax-free growth and secure retirement planning.

Pro Tip: Contribute the maximum allowable amount to these accounts annually to optimize growth.

5. Embrace Dividend Growth Investing

Dividend-paying stocks offer a dual advantage: steady income and growth potential. Companies with a history of increasing dividends are typically financially stable.

How to Succeed with Dividends:

- Reinvest Earnings: Compound your returns by reinvesting dividends.

- Focus on Blue-Chip Stocks: Look for companies with consistent dividend growth.

Platforms like Morningstar can help you identify top-performing dividend stocks.

6. Stay Committed with Dollar-Cost Averaging

Dollar-cost averaging (DCA) is an effective strategy for managing risk and building wealth over time.

Benefits of DCA:

- Reduces Timing Risk: Invest consistently, regardless of market conditions.

- Encourages Discipline: Automate your investments to stay on track.

- Lowers Volatility Impact: Buy more shares when prices are low and fewer when they’re high.

Many investment platforms allow you to automate this process for seamless investing.

7. Explore Bonds for Stability

Bonds are a crucial component of any balanced portfolio. They provide predictable returns and reduce overall portfolio risk.

Types of Bonds to Consider:

- Government Bonds: Low risk and reliable.

- Corporate Bonds: Higher returns with moderate risk.

- Municipal Bonds: Tax benefits for residents of specific states.

Pair bonds with equities to create a well-rounded strategy that weathers market fluctuations.

8. Consider Alternative Investments

Beyond traditional stocks and bonds, alternative investments can add a new layer of diversification and growth potential.

Examples of Alternatives:

- Commodities: Hedge against inflation with gold or silver.

- Private Equity: High-return opportunities for experienced investors.

- Cryptocurrency: Emerging market with significant growth potential.

Invest cautiously, as these options are typically higher risk and require careful research.

9. Leverage Professional Financial Advice

Navigating the complexities of investing is easier with professional guidance.

Why Hire a Financial Advisor?

- Personalized Strategies: Tailored to your goals and risk tolerance.

- Market Expertise: Advisors understand market trends and tax implications.

- Peace of Mind: A trusted advisor ensures you stay on track.

Choose a fiduciary advisor to ensure decisions are in your best interest.

10. Monitor and Rebalance Your Portfolio

Regular portfolio reviews are essential to maintaining alignment with your financial goals.

Key Steps to Rebalance:

- Set a Schedule: Review your portfolio quarterly or annually.

- Adjust Allocations: Sell overperforming assets and reinvest in underperforming ones.

- Use Tools: Platforms like Groww or Vanguard offer rebalancing features.

Rebalancing ensures your portfolio remains optimized for long-term success.

Conclusion

Long-term investing isn’t about quick wins; it’s about creating a plan that grows with you. By diversifying your portfolio, leveraging tax-advantaged accounts, and staying consistent, you can achieve financial freedom and peace of mind.

CTA:

Ready to start your journey to financial independence? Subscribe to our newsletter for more tips and strategies, or begin investing today with a trusted platform like Groww or Vanguard. Your future self will thank you!