Celebrity realtor and “Selling Sunset” star Jason Oppenheim is raising alarm bells about California’s skyrocketing fire insurance rates — and says the devastating wildfires that tore through Los Angeles neighborhoods earlier this year are to blame. According to Oppenheim, the aftermath of these fires isn’t just affecting local homeowners — it’s reshaping the state’s entire real estate insurance landscape for years to come.

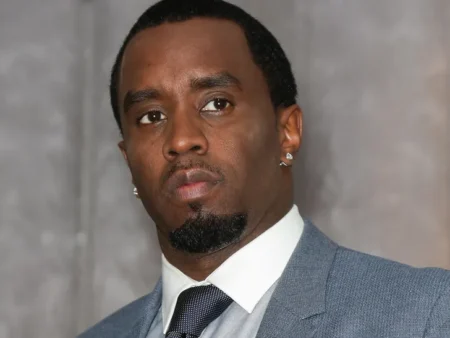

Caught on Camera: Jason Speaks Out at LAVO in West Hollywood

Jason Oppenheim spoke exclusively to TMZ outside LAVO, a trendy Italian restaurant in West Hollywood, on Friday night while heading into his birthday dinner. Even amid birthday celebrations, the top-selling realtor made it clear: California’s fire insurance situation is no joke.

When asked about the recent spike in fire insurance costs, Oppenheim confirmed what many Californians are beginning to feel in their pockets — rates soared immediately after the destructive wildfires in January 2025.

Insurance Rates Surge After LA Wildfires

The January wildfires, which ravaged neighborhoods such as Pacific Palisades and parts of Malibu, left a trail of devastation across Southern California. According to local reports, the fires burned through thousands of acres, destroyed hundreds of homes, and tragically claimed the lives of 30 people.

In the weeks following the disaster, homeowners have seen their fire insurance premiums skyrocket by 20–30%, with many even unable to renew their existing policies. Oppenheim explains that although the market is slowly correcting itself, rates are unlikely to return to pre-fire levels.

He even joked that unless “AI drones can instantly put out wildfires,” homeowners will continue to see higher premiums year after year.

Jason’s Clients Are Now Renting Instead of Rebuilding

Interestingly, Oppenheim revealed that many of his high-profile clients whose homes were destroyed in the January fires have chosen not to rebuild. Instead, they’re renting luxury homes, which allows them to avoid the sky-high cost of fire insurance altogether — at least for now.

This trend may be a glimpse into the future of California’s luxury real estate market, where uncertainty about climate-related disasters is prompting even wealthy homeowners to rethink long-term property ownership.

Industry Experts Back Jason’s Claims

To further understand the long-term impact of these rising insurance costs, TMZ also consulted housing and insurance experts, including Karl Susman of Susman Insurance Agency and James Respondek of Rodeo Realty.

Susman confirmed that the property insurance market has been trying to stabilize for years. Unfortunately, the frequency and intensity of wildfires in California have made it nearly impossible for insurance companies to assess accurate risk levels. As a result, rates continue to climb, and the entire system is undergoing a bureaucratic overhaul.

“The January wildfires were the last straw,” Susman said. “It’s becoming harder and harder for companies to determine what a total loss looks like — and how to price it accordingly.”

State Farm Seeks Emergency Rate Hike

Adding more fuel to the fire, Respondek dropped a bombshell — State Farm, one of the nation’s leading insurers, is reportedly seeking an emergency 22% rate hike for homeowner policies in California. If approved, this move could trigger even more price increases across the board, making fire insurance even less accessible for the average resident.

“Climate change is a major factor,” Respondek explained. “This isn’t just a California issue — this is going to affect other states too. But for now, Los Angeles is ground zero.”

According to Respondek, some homeowners in wealthy enclaves are now paying hundreds of thousands of dollars per year just to insure their mansions against fire damage.

Some Insurers Are Abandoning California Entirely

The situation has become so dire that some insurance companies are completely pulling out of the California market, refusing to write new policies for homes located in high-risk fire zones. This exodus is creating a supply-and-demand crisis where fewer insurance options are available, driving prices up even more.

For homeowners who can still get insurance, many are finding that their coverage isn’t enough — a reality that Pacific Palisades resident Walter Lopes experienced firsthand.

Homeowner Rebuilds, But With a New Insurance Plan

Lopes, who was the first to rebuild in his fire-ravaged neighborhood, shared his personal story with TMZ. While grateful that he was able to reconstruct his home, he admitted that his previous insurance coverage was insufficient, and he’s now shopping for better policies — even if it means paying more.

“I’m not an insurance expert,” he admitted. “But I want a company that has my back. If they’re going to charge me more but guarantee that they’ll take care of me when the next fire comes, then I’m fine with it.”

His experience highlights a growing sentiment among California homeowners — reliable coverage matters more than ever, even if it comes at a premium.

What This Means for California’s Real Estate Market

Oppenheim’s insight — paired with confirmation from top real estate and insurance insiders — paints a troubling picture for the future of California homeownership:

- First-time buyers may be priced out of the market due to unaffordable insurance premiums.

- Investors could shy away from the state’s riskier zones, causing demand to drop in certain areas.

- Luxury clients are opting to rent rather than rebuild, reshaping how people approach property ownership in fire-prone areas.

- Insurers are retreating, leaving fewer options for residents who need comprehensive protection.

The fire insurance crisis could also affect the overall property values in high-risk zones, as potential buyers weigh the long-term costs of insuring their investment.

Oppenheim’s Advice: Let the Free Market Work

Despite the challenges, Jason Oppenheim remains optimistic — to a point. He believes free market capitalism will eventually bring some balance to the insurance industry. If enough demand exists for affordable, comprehensive coverage, insurers will have incentive to return to the market and compete on pricing.

But until then, he warns that all Californians — not just those in wildfire zones — should prepare for higher costs.

Conclusion: A New Reality for California Homeowners

The devastating Los Angeles wildfires of early 2025 were a wake-up call — not just for local residents, but for the entire state of California. With insurance rates soaring, companies pulling out, and climate risks increasing, homeowners now face a future where protecting their property is more expensive, more complicated, and more uncertain than ever.

As Jason Oppenheim bluntly put it, “This is the new normal — and it’s only going to get worse unless something major changes.”